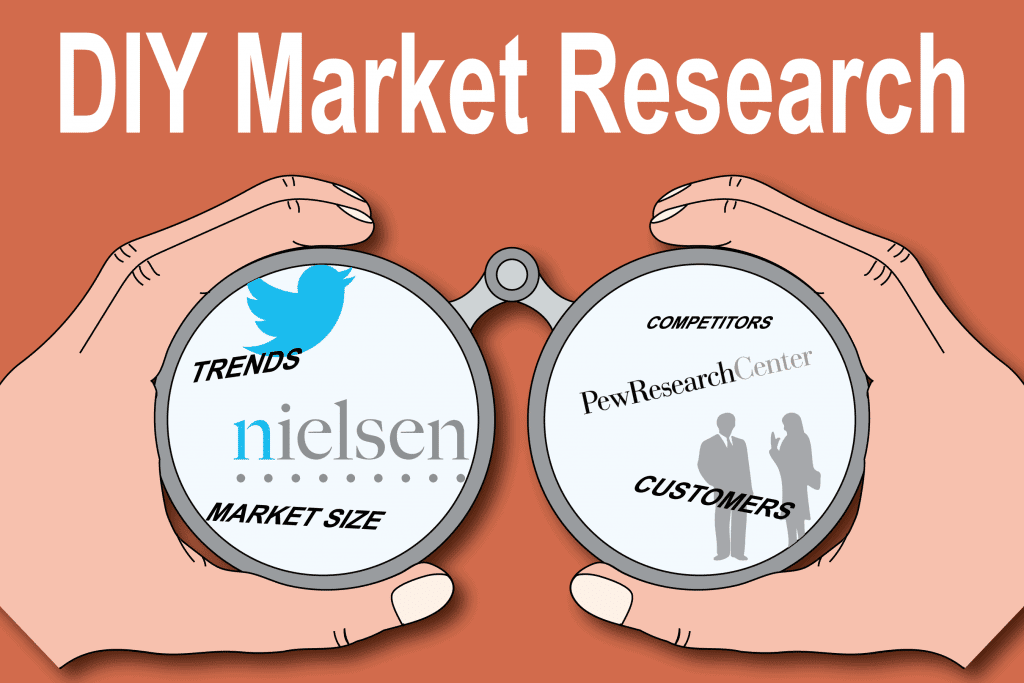

Market research is simply the process of finding answers to your questions about the market, your customers, and your competitors. Whether you’re launching a new business or growing an existing one, you can use Do-It-Yourself (DIY) market research to answer key questions, such as:

- What trends are on the horizon? How can I use them to help me create or improve my products?

- Are there people who want to buy my product or service, and if so, what’s the best way to reach them?

- How many potential customers can I attract?

- Who’s my competition?

- Who are my current customers? How do they like what I offer?

Market research firms can provide the information you need or research it for you, BUT they usually charge thousands of dollars. Here are some free and low-cost tools you can use for Do-It-Yourself (DIY) market research.

Work Smarter, Not Harder

First, figure out what you need to know. Unless you need specific information to attract investors or get a loan, focus on getting intel that will help you make better decisions for your business, such as finding the best locations, creating innovative products, or increasing customer loyalty.

Once I have a list of questions, I take a quick online search to see if I can find free or low-cost research, such as consumer surveys, reports, and other types of data that other people have already collected or analyzed. If I can get a good-enough answer from their research, great.

If I have questions that are unique to my business, however, I do my own research. I seek to answer my questions by reviewing sales data, interviewing prospective buyers or customers, attending trade shows, visiting stores, conducting surveys, holding focus groups, etc.

Common Research Topics

While there’s a lot of science behind conducting statistically valid market research, I can almost always get useful information just by asking the right questions, watching, and listening.

I like to divide research into four categories: spotting trends, analyzing competitors, estimating market size and share, and understanding my customers.

I like to divide research into four categories: spotting trends, analyzing competitors, estimating market size and share, and understanding my customers.

While there’s a lot of overlap among these categories, it helps me think about what I need to know and how to get the answers.

1) Trendspotting

The  point of trendspotting is to understand what’s going on in your industry or category now, forecast future sales, and pick the hot companies and people to monitor. Here’s the case for why business owners need to be futurists.

point of trendspotting is to understand what’s going on in your industry or category now, forecast future sales, and pick the hot companies and people to monitor. Here’s the case for why business owners need to be futurists.

- As I noted in How to Become a Trend Spotter, the best way to do your own trendspotting is to attend trade shows, conferences, and events, looking for innovative companies, common themes, and out-of-the-box ideas that are just wacky enough to catch on. Can’t attend? Search online to find press coverage of the award winners and critics’ favorites.

- Innovations often start on the West or East Coast, so when you’re in a coastal city, keep your eyes open for new ideas.

- As my mother used to say, “If you keep something long enough, it’ll always come back in style,” so keep your eye out for old trends that are ready for a comeback. While I haven’t seen anyone in a Nehru jacket on Newbury Street lately, check out the return of Nintendo Classic.

- Don’t just look at your own industry, because trends percolate across categories. For example, the Garden Media Group publishes an annual Garden Trends Report that’s useful for anyone interested in consumer trends in the natural living, home decorating, arts, and specialty food industries, not just horticulture. And I’m always fascinated by the Pantone Color Institute’s choice for Pantone Color of the Year. They analyze the cultural climate and tries to forecast the national mood two years down the road.

- Once you’ve identified the leaders and innovators in your category, follow them on social media and like and comment on what they share. Try to connect with them offline, too.

| Trendspotting Resources Almost any good industry website or blog regularly covers trends for your category. In addition, social media channels and search engines are also good ways to spot trends.

|

2) Conducting a Competitive Analysis

Whether you consider them peers or competitors, it’s always useful to know about the national, regional, and local leader(s) in your category. Who are their target markets? What is their market share? What are their price points? How are the products or services you offer similar or different? What can you do to stand out?

you consider them peers or competitors, it’s always useful to know about the national, regional, and local leader(s) in your category. Who are their target markets? What is their market share? What are their price points? How are the products or services you offer similar or different? What can you do to stand out?

Company websites, social media, and online business directories are all good places to start your search. Trade associations usually have directories, websites, and publications to consult, but attending their events and making personal contacts is the best way to get an inside view. Yelp and other consumer rating sites are easy places to find the most popular competitors.

It’s usually easier to gather intel about large companies than small businesses, because journalists are more likely to write about them. If you’re having trouble finding information about your competitors, look for businesses in other cities that are similar to your competitors that you can research, visit, call, or email. Most businesses will be glad to help you out if you’re not a direct competitor.

Competitive Analysis Resources

|

3) Estimating Market Size and Share

The easiest way to get market size information is to buy it—if you have the bucks. Companies like Packaged Facts sell incredibly detailed reports for thousands of dollars, way beyond the budget for most small businesses. But you can often get the market size information you need just from their press releases and report overviews or by searching for media articles that reference the data from those reports.

you need just from their press releases and report overviews or by searching for media articles that reference the data from those reports.

If you’d would rather do your own research, there are two main approaches to estimating market size: top-down and bottom-up.

| Top-Down Method | Bottom-Up Method |

|---|---|

| Step 1: Conduct an online search to find the annual sales of your product category in your market area. If you have the NAICS industry code, you can often find government statistics. If you can’t find the total sales for your target area, look for sales statistics for a different market area. Compare the population in your target area to the area you have data for and adjust your market size proportionally up or down. |

Step 1: Find out:

|

| Step 2: Take a stab at determining your potential market share. Make a case for what portion of the market would switch to your product. What new features, services, or value are you offering? What type of people would be likely to buy? Create a few scenarios—say, 1%, 5%, and 10% of a million-dollar market.If you’re selling a completely new concept or product, base your estimates on an existing product that serves the same type of customers. |

Step 2: Multiply number of outlets by number of products by volume and order size, and you’ll have a rough idea of the market size.*Tip: If you can, visit every outlet to get a feel for whether your product would be a good fit. Try to meet with the buyer to gauge their interest in carrying your product. Make a case for why their customers would switch to your brand. |

| Step 3: Multiply your estimated percentage of market share by the total market size you determined in Step 1 to get your projected annual sales. |

Step 3: Estimate your annual sales based on the total market size and the share of the market you think you can capture. |

Market Size and Market Share Resources

|

4) Understanding Your Customers

Understanding your current or potential customers’ wants, habits, and motivations is key to providing a product or service that they want to buy.

There are also surveys, articles, and databases about buying habits and preferences for almost every type of consumer and product, so start with an online search to see what type of secondary research is already available. If possible, find out how they feel about existing brands that are similar to yours. But since every business is unique, you’ll probably need to supplement the generic data with information about your own customers.

Want to know how frequently your customer buy, amount of average sale, and how long you’re keeping them?

- If you have a Point of Sale (POS) system, you can probably find out their zip code and purchasing behavior.

Want to know more about your customers in general?

- If you’ve configured

Google Analytics to track demographics and interests on your website, you can find out the age, sex, and interests of your website visitors. You can also see what pages get the most views and how you’re attracting people to your site.

Google Analytics to track demographics and interests on your website, you can find out the age, sex, and interests of your website visitors. You can also see what pages get the most views and how you’re attracting people to your site. - You can also get the age, sex, and interests of your fans on Facebook, Twitter, Instagram and other social media accounts.

- If you have access to Demographics Now through your library, you can upload your customer database to get lifestyle profiles of your customers through Mosaic USA.

- If you want general information about people who live or work in your area, such as age, race, educational level, household income, house ownership, commuting distance, you can get it from the U.S. Census or by doing an online search for “demographics [your town].”

Want more specific information about your customers, such as their likes and dislikes, satisfaction, and why they buy?

- Just ask! You can do an online customer survey, a Facebook poll, interview them, or run some focus groups.

Want to research potential customers or get anonymous feedback on a product concept, name or logo?

- If you need statistically reliable data, you may need to hire a market researcher to recruit people to test your app, be a mystery shopper, or run a focus group.

- But you can create an online survey and purchase an audience of survey takers (specified by location, age, interests, etc.) for as little as $200.

Resources for Understanding Your Customers

|